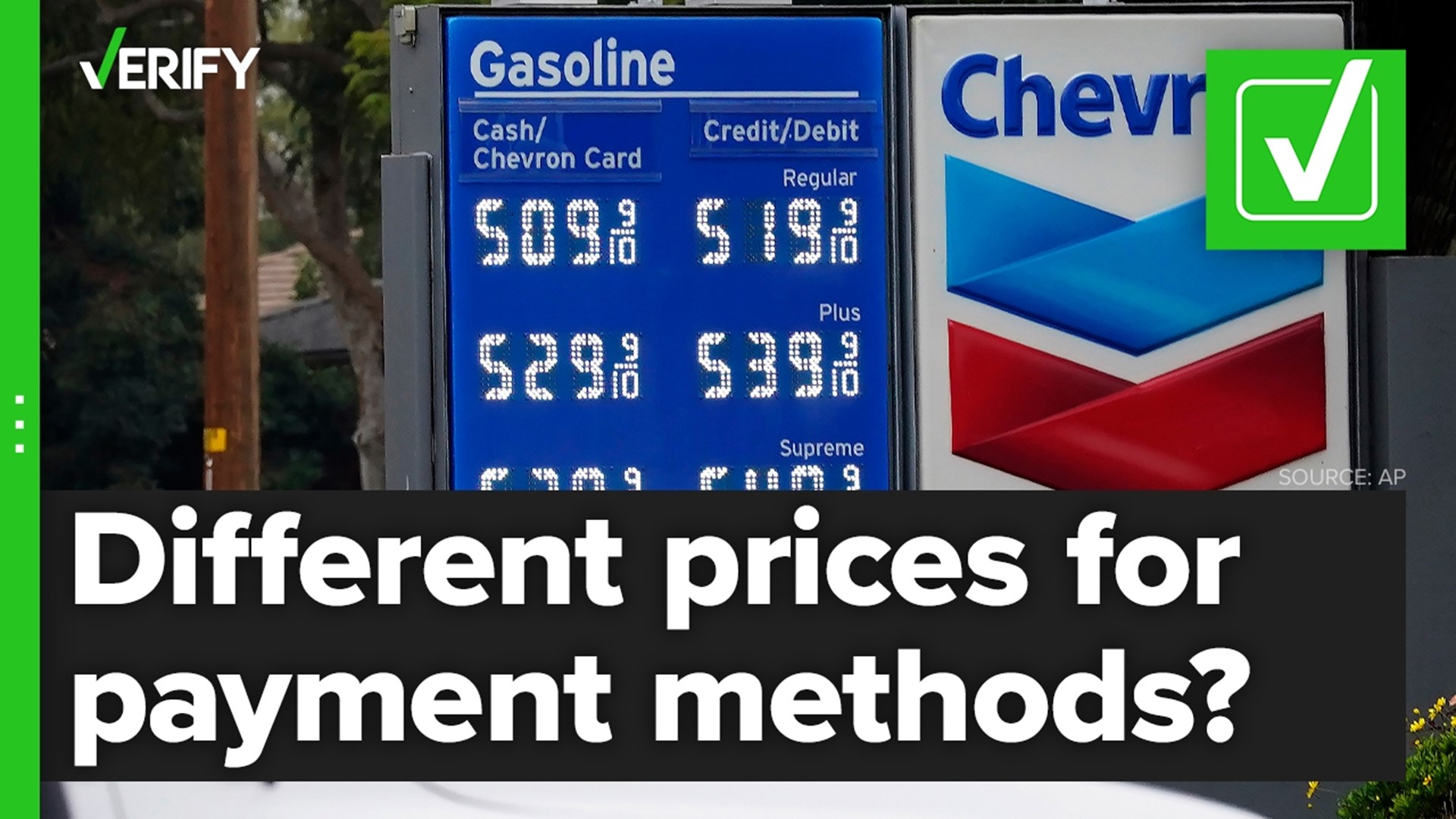

It’s likely you’ve seen a gas station post two prices for its fuel: one for cash, and one for credit. The cash price is always lower than the credit price.

Yzael texted VERIFY to ask if this practice is actually legal.

“Is it allowed?” Yzael asked. “If not, how do we report it? If it is, why is it allowed?”

THE QUESTION

Can a gas station charge different prices for different payment methods?

THE SOURCES

THE ANSWER

Yes, gas stations can charge different prices for different payment methods.

WHAT WE FOUND

Gas stations can charge different prices for cash and credit to cover credit card processing fees. Gas stations are subject to the same rules as other merchants, like restaurants.

According to the Association for Convenience and Petroleum Retailing (NACS), credit card processing fees at gas stations average about 2.5% of the total transaction price. As of June 9, 2022, AAA says the national average for a gallon of gas is $4.97, which would make the processing fee about $0.12 to $0.13 per gallon.

The National Merchant Association says there are two ways for a retailer, like a gas station, to charge different prices depending on your payment method: Add a fee to credit card purchases or give a discount to cash purchases.

There are 10 states that have laws against credit card surcharges — the fee a retailer adds to a credit card purchase to cover the processing fee — the National Conference of State Legislatures says. But every state allows for cash discounts, which are protected by U.S. Code, so that retailers can encourage customers to use payment methods that are cheaper to process.

The NACS says consumers are far more likely to see cash discounts at the pump because fierce gas price competition makes gas retailers wary of surcharges. NACS has repeatedly surveyed customers about their price sensitivity at the pump and has found that nearly half of all consumers would change their behavior to save 5 cents per gallon.

“NACS is not aware of any retailer that is instituting a surcharge program,” NACS said in a Q&A on credit card surcharging. “It is important to note that discounts for cash or debit card payments are widespread, but these are discounts, not surcharges.”

Although most states have laws that require gas stations to clearly advertise both their cash and credit prices, the exact rules regarding how gas stations handle cash discounts differ from state to state.

A Connecticut research report of gas station cash discount rules in Connecticut, Massachusetts, New York and Pennsylvania found there were three different rules on signage between the four states.

Connecticut and Massachusetts both require gas stations “to post clear and conspicuous signs with both the credit card and cash prices.” In New York, street signs “do not have to show both credit and cash prices, but whichever price is advertised should be clearly and correctly labeled in letters large enough to be read from the road.” In Pennsylvania, gas stations must “post the higher credit card price on its street signs,” but they’re allowed to still post the lower cash price alongside the credit card price.

The Consumer Financial Protection Bureau says a cash discount may be in whatever amount the seller desires, either as a percentage of the regular price or a dollar amount. That means any regulation on the size of a gas station’s cash discount will be from the state or local level. Typically, the price difference is somewhere between five and 10 cents.

“Amounts for the discount vary, but most retailers offer approximately five cents off per gallon to customers paying by cash,” NACS said on May 19, 2022. “Some retailers offer significantly higher discounts for cash, particularly if the gas purchase is tied to another purchase, such as a car wash.”