PORTLAND, Maine — If you believe the world will take steps toward a greener future, a world in which we emit less CO2, you can place a "bet" on that belief in the form of an investment, right from the comfort of your couch.

And, no, we’re not talking about buying stock in Tesla, Rivian, or the latest electric vehicle darling. We’re talking about carbon credits.

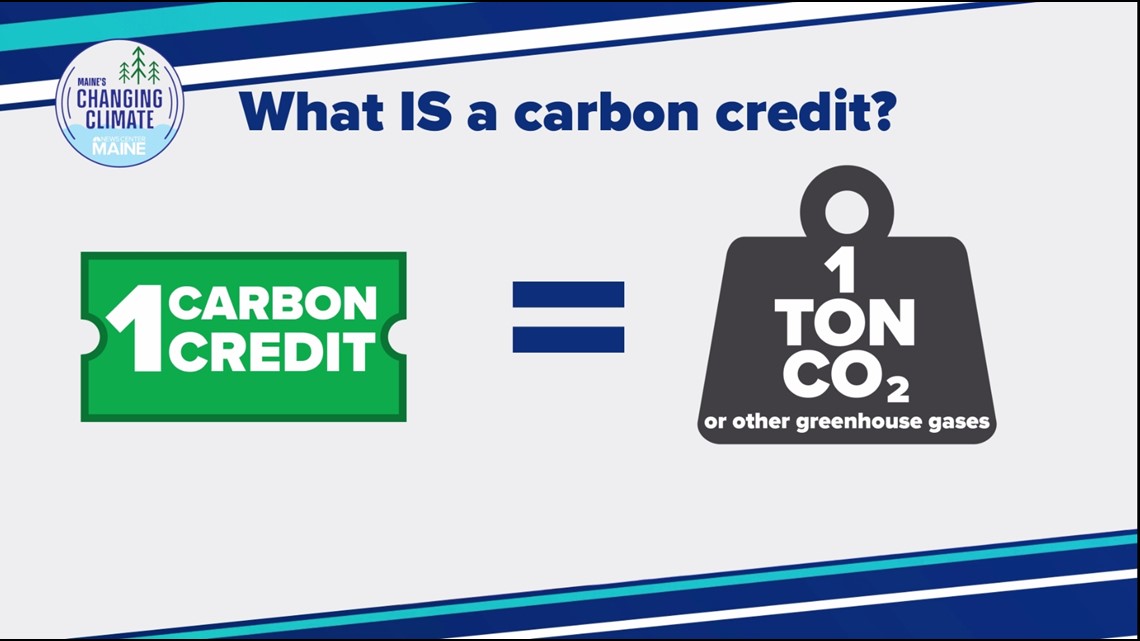

A carbon credit, according to an article on Investopedia, is a permit issued by a national or international governmental body that entitles a business to emit a set amount of CO2. One credit equals 1 ton of CO2 or other greenhouse gases.

Companies are issued credits that allow a certain volume of emissions, and that limit is reduced slowly over time in order to limit total emissions and trend downward.

However, if a company produces less pollution than their designated carbon credit limit, they can sell remaining credits to another company that is going to pollute more than allowed.

This system is known as a cap-and-trade program, and it produces a double economic incentive to emit less carbon. First, companies don't have to pay for additional credits. Second, they can profit by selling unused credits to another company.

Herein lies the opportunity for investors to get involved with Exchange Traded Funds, or ETFs.

“[Individual investors] can’t actually buy the carbon credits directly, but there are ETFs that track the price of the carbon credit," Eben Jose of Spinnaker Trust in Portland said. "Those really came out over the past year to year and a half and now any investor can participate in this market.”

Jose said the largest ETF by volume is KraneShares Global Carbon Strategy ETF, or KRBN. It tracks a group of carbon credits, including the European Union, California, and the New England systems.

Because these ETFs are a speculative asset, investors would be making a bit of a prediction by going long on one of these ETFs. The prediction has to do with how the European Union and the United States especially could tackle climate change.

"I think you’re trying to bet on the idea that these carbon credits need to increase in value in order for a lot of governments to meet their emissions goals," Jose said. "Those goals are very aggressive, and they won’t be met unless the carbon price continues to increase to kind of drive that change to happen faster.”

If you are someone who doubts whether climate change issues will be taken seriously by governments in the future, this may not be the right investment product for you.

However, there may be a spot for a carbon ETF in your portfolio, even if you aren't passionate about the topic yourself. That’s because carbon credit ETFs have so far exhibited a relatively low correlation to other asset classes. As such, they could potentially be used as a hedge in certain portfolios.

Over the past year, KRBN has increased in value by about 75 percent, but remember that past performance is no guarantee of future returns.