WASHINGTON, D.C., USA — Small business lifeline loans through the Paycheck Protection Program were coming down to the last few weeks and for some days.

The original Small Business Administration loans through the CARES Act coronavirus relief bill came quickly and lacked guidance. For two-months, business owners were waiting for the final rules for loan forgiveness, and new legislation, passed through the Senate unanimously Wednesday, provided more clarity.

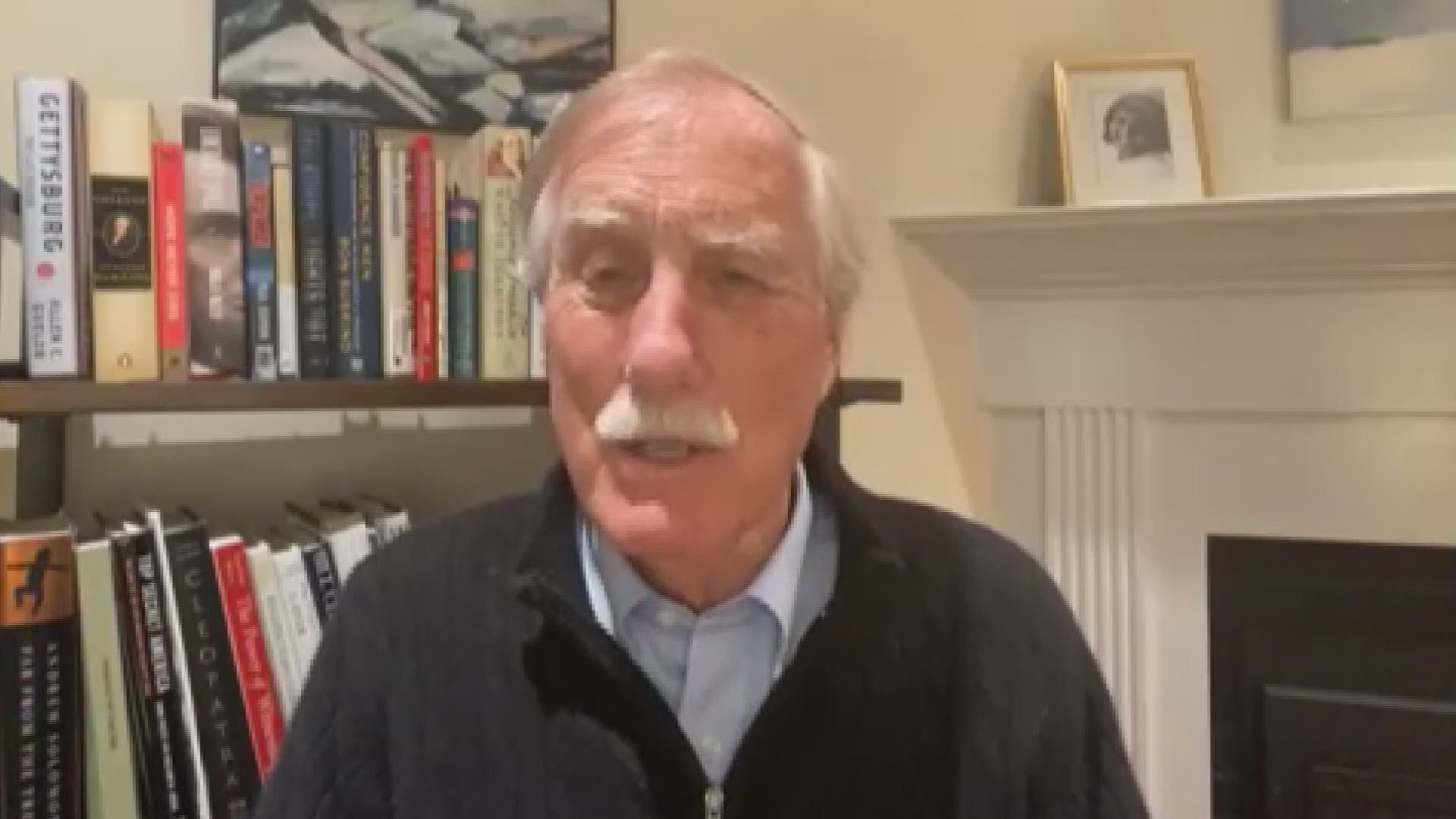

H.R. 7010 mirrors a bill Sen. Angus King, I-Maine, co-introduced to the Senate on May 21. King says it gives more flexibility for businesses that didn’t fit within the constraints of the original bill.

The Paycheck Protection Flexibility Act gets rid of the eight-week deadline and extends it to 24-weeks for those with existing PPP loans to spend money. Currently, the deadline to rehire workers is June 30, but the act extends it to the end of the year.

“What we are really doing here is, I call it a mid-course correction," said King. "We are putting in some flexibility to deal with some of the unintended consequences.”

SBA guidelines during the first round of PPP loans stated if 75% of loans were used on payroll and 25% were used on other expenses, such as rent or mortgage insurance, it would be forgiven.

Under the Paycheck Protection Flexibility Act, it would drop it down to 60% on payroll and 40% on non-payroll expenditures.

King says this will fix the 'one size fits all' approach.

“I think we’ve got to recognize here that this was a huge program that went into place in a real hurry, in a matter of weeks. The SBA in a normal year would do about $39 billion in loan guarantees. This program was $500 billion in about two months," said King.

King says at last check there is $150 billion available in unallocated funds for businesses that still need to apply.

“This is a win for everybody, totally bipartisan. I think it’s a good example of, ‘Hey, Congress can occasionally get it right in a reasonably short amount of time. Who knew?”

The bill now awaits President Trump's signature.

More from Sen. King's Office on Paycheck Protection Program Flexibility Act:

1. Allow forgiveness for expenses beyond the 8-week covered period. The 8-week timeline does not work for local businesses that are prohibited from opening their doors, or those that will only be allowed to open with restrictions. Businesses need the flexibility to spread the loan proceeds over the full course of the crisis until demand returns. Otherwise, employees will simply be furloughed at the expiration of the 8 weeks. This provision will allow the businesses that already have PPP loans to choose between using their loans in the initial 8 weeks or extending the period for up to 24 weeks.

2. Reduce restrictions limiting non-payroll expenses to 25% of loan proceeds. In order to survive, businesses must pay fixed costs. The SBA requires PPP loan recipients to use 75% of their loan in order to qualify for loan forgiveness. For many businesses, payroll simply does not represent 75% of their monthly expenses and 25% does not leave enough to cover mortgage, rent, and utilities. Retaining employees is not possible if a business cannot retain its physical location. Under the version of the legislation passed by the House, up to 40% of PPP funds could go to non-payroll expenses.

3. Eliminate restrictions in new loans that limit loan terms to 2 years. According to the American Hotel and Lodging Association, full recovery for that industry following both the September 11, 2001, terrorist attacks and the 2008 recession took more than two full years. This is the same for many other industries. If the past is any indication of the future, it will take many businesses more than two years to achieve sufficient revenue to pay back a PPP loan if they do not achieve full forgiveness.

4. Ensure full access to payroll tax deferment for businesses that take PPP loans. The purpose of both the PPP and the payroll tax deferment provision included in the CARES Act was to provide businesses with capital to weather the crisis. Receiving both should not be considered double-dipping. Businesses need access to both sources of cash flow to survive.

5. Extend the rehiring deadline to offset the effect of enhanced Unemployment Insurance. To receive loan forgiveness under PPP, a business must rehire employees by a deadline of June 30, 2020. However, the enhanced Unemployment Insurance created through the CARES Act is higher than the median wage in 44 states. Many businesses have reported an inability to rehire employees because they are making more on Unemployment than they made working. To mitigate this unintended consequence, the bill extends the deadline to rehire employees under PPP.

6. Adjusts program’s standards to account for economic realities following the coronavirus pandemic. If economic conditions prevent businesses from reaching pre-coronavirus revenue levels and businesses aren’t able to rehire all employees, this legislation would make sure businesses are still able to receive loan forgiveness.