Here's what you need to know about it.

The property owner must be enrolled in the Homestead Exemption Act for at least 10 years.

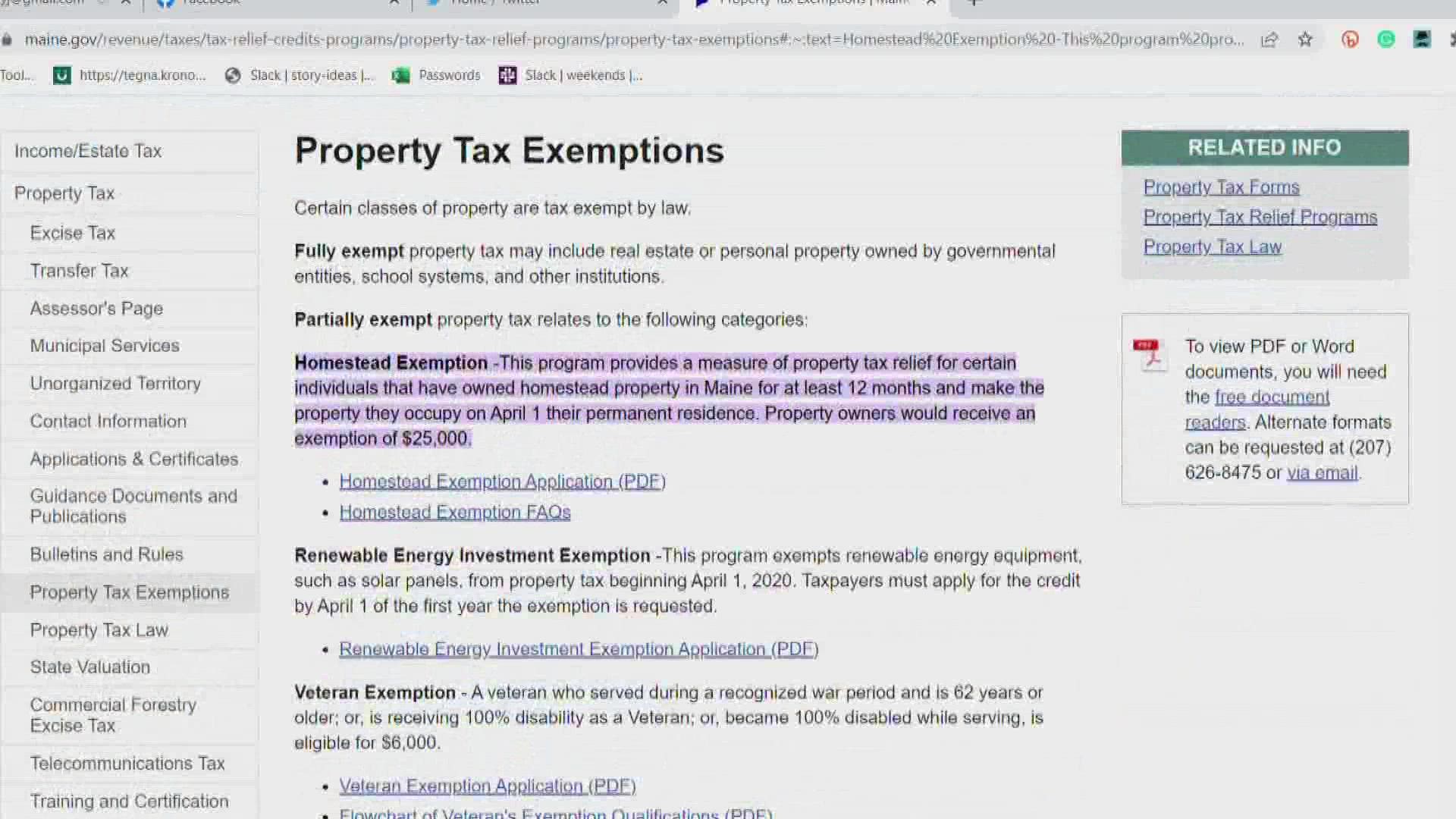

The Homestead Exemption Act "provides a reduction of up to $25,000 in the value of your home for property tax purposes," according to the State Revenue Services website.

By holding a homestead, Maine has to be your permanent residence. Senator Trey Stewart, R-Aroostook, said that's the goal of this bill, too.

"We wanted this to be targeted towards senior citizens who actually live in Maine," he added.

By tacking onto the Homestead Exemption Act, this act essentially freezes the owner's property tax as long as they remain enrolled in the exemption.

"The net effect will be zero to the town, but a huge benefit for senior citizens across Maine," Stewart said.

The law goes into effect in one month and applications need to be submitted by December first.