MAINE, USA — The housing market has been nothing short of exasperating over the past few years. Now, many Mainers and Americans are asking this question: Is it more affordable to buy or rent a home right now?

Tyler Hafford is a financial advisor and certified financial planner at Penobscot Financial Advisors. He said a "perfect storm" of factors has resulted in the current state of the housing market, including inflation, wage growth, higher interest rates, and a lack of housing stock. For all of those reasons, Hafford said the market is actually favoring renters right now.

"Today, you have the decision to say, ‘Am I going to put this big chunk of money down on a home, or can I use it in other places to build my wealth?’” Hafford said.

Hafford said some other places to invest instead include the stock market, bond market, and high-yield savings accounts. He said those could help prospective first-time homebuyers build up their wealth.

According to a report released last month from the Maine Association of Realtors, the median sales price of a home in our state went up 13% in Oct. 2023, compared to the same month in 2022.

Hafford said the only way it makes sense financially to buy a home in this market is if someone is planning to be in that house for at least a decade to avoid a dip in the housing market. He said you can always refinance if that's what you choose to do.

“In 2006, housing prices peaked. We had the following housing bubble kind of pop on us and collapse. Those values on those homes did not return to the peak until 2017," Hafford said, offering an example.

Melanie Crane, the owner and associate broker of Elevate Maine Realty with Keller Williams, has a different perspective. She said she still thinks there are lots of reasons for people to buy, including tax benefits, stability, and equity.

"You’re always going to be paying a mortgage, whether it’s your own or someone else’s," Crane said.

Crane said she believes the most important thing a prospective homebuyer can do is learn, so they can make an informed decision. She said it's also important for people to keep the current interest rates in perspective.

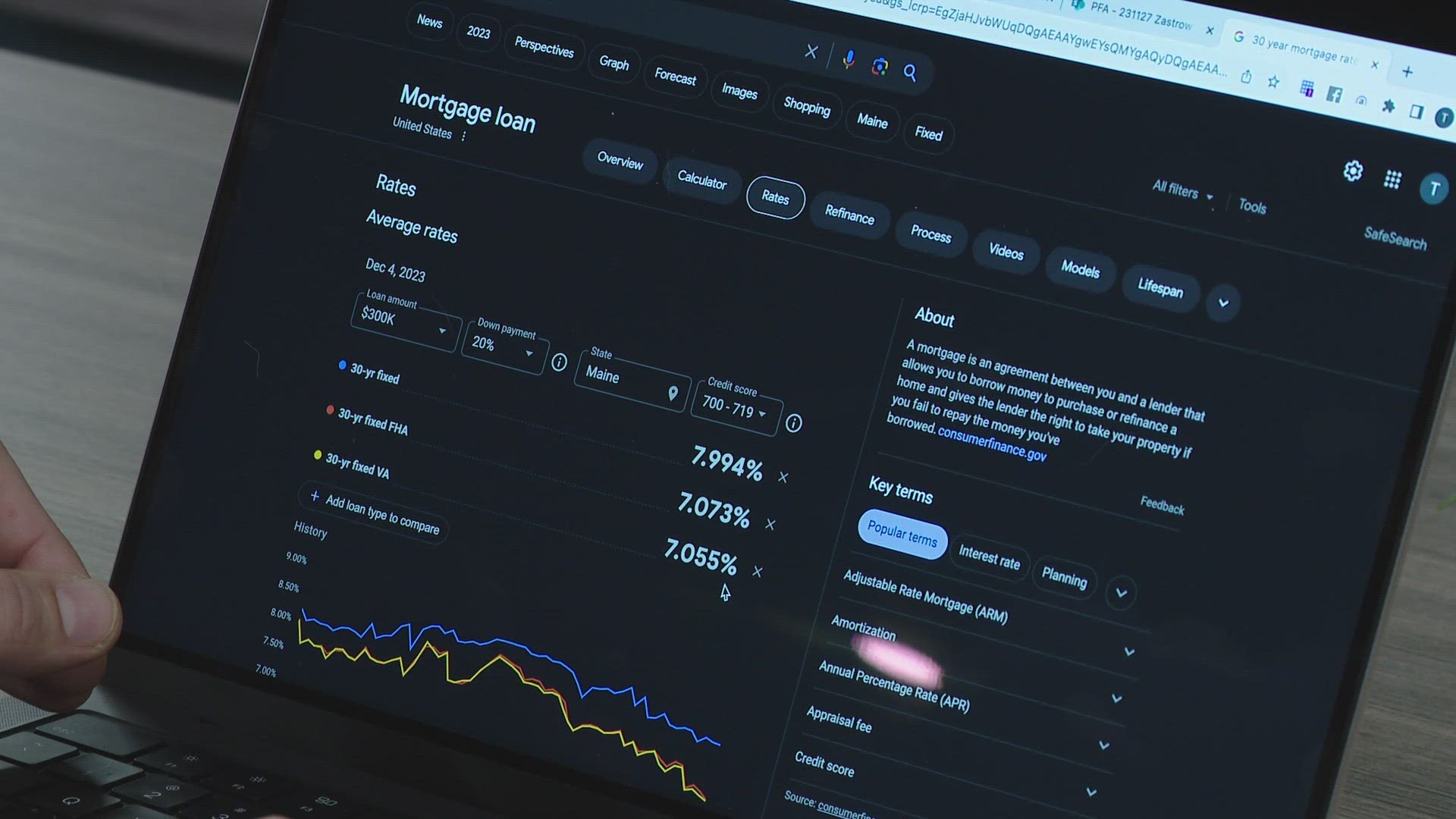

"Interest rates are cyclical, and they have been for decades," Crane said, later adding, "If we look back over 50 years, 7.5% has been the average interest rate.”

The Maine State Housing Authority offers a First Home Loan Program, providing education, help with a down payment, and lower interest rates for people considering buying their first home. Jonny Kurzfeld, the director of planning and research with MaineHousing, said deciding whether to buy or rent should happen on a case-by-case basis.

"The kind of cost-benefit analysis is a highly personal one when you’re actually thinking about buying a home," Kurzfeld said.

Kurzfeld said discussions are happening now in our state to address some issues affecting the housing market, like a lack of stock.

“Across the nation, we see housing shortages pretty much everywhere," Kurzfeld said. "We need more housing to be built for all types of homebuyers.”

Kurzfeld said he's hopeful progress will be made over the next five to 10 years.