MAINE, USA — Peter and Mary Ann Brickfield split their time between Washington, D.C., and Islesboro, an affluent island community off the coast of Maine.

By their late 60s, they had given up high-powered careers as a lawyer and the chief of the Neurocytology Unit at the National Institutes of Health for a quiet retirement in their $1.7 million home on the island. Mary Ann’s plan was to care for Peter, who had been diagnosed with dementia. The Waldo County Probate Court appointed her to be his guardian and conservator.

But Mary Ann developed a terminal illness that left the childless couple looking to Michael Boucher, the longtime caretaker of their properties, to manage the final years of their lives. More than $3 million was spent during the next three years to care for the Brickfields while Boucher was conservator and trustee, probate court records show.

Boucher’s accounting of the trust’s spending caught the attention of the probate court judge, who ordered Teri McRae, a nationally certified guardian, to review how a multimillion-dollar trust set up by the Brickfields was being spent. McRae said in court reports that it appeared that $400,000 may have been overspent “grossing up” wages and paying taxes for employees — some of whom were Boucher’s family members.

Yet even when supplied with a report of alleged mismanagement and with nearly half a million dollars in dispute, no one — not the private company that eventually took control of the Brickfields’ trust nor the state attorney general’s office that oversees charitable trusts — tried to recoup the money. No one was charged with a crime, and Boucher himself denies any wrongdoing.

Buried in Maine’s overburdened probate courts are the life savings of people in a state with the oldest average population in the country. In one example after another, those savings have been spent down by conservators, taken by family members, or sometimes redirected in wills to once-trusted lawyers for their personal gain.

The state’s probate courts do not have investigators or accountants to track the finances of vulnerable adults and make sure they are protected from theft, an investigation this year by The Maine Monitor uncovered. And some probate courts have failed to put safeguards in place even after blind spots in their systems were exploited.

“We need to have something more in place — reporting and looking out for people, whether they’re under the state’s care or under private care, whether it’s a guardian or a conservator,” said Catherine Moore, register of the Lincoln County Probate Court.

An estimated $4 million is lost annually by older Mainers as a result of financial exploitation, according to a study by the state’s Adult Protective Services office and the legal-aid nonprofit, Legal Services for the Elderly. That includes all types of fraud, from diversion of cash to shady contractors to the loss of a home.

The probate courts are unlike any other court in Maine. They are 16 independent courts with budgets set by each county and run by elected part-time judges. A constitutional amendment passed by voters 56 years ago said probate courts must be overhauled and assigned full-time judges, but lawmakers did not make that happen.

The antiquated, underfunded and understaffed probate courts have left Mainers vulnerable to being ripped off. A Monitor survey earlier this year of 10 of the state’s probate courts revealed that many do not audit conservators or guardians.

States such as Minnesota and Florida created independent offices within their court systems more than a decade ago to detect fraud and financial exploitation of people under the jurisdiction of the probate courts. Maine has stuck with paper accountings and informal reviews.

Supporters of Maine’s probate courts say they are efficient and save money, allowing families to avoid hiring a lawyer to divide up assets after a death. But the courts rely heavily on people acting in the best interest of the estate rather than themselves, and there are few checks built into their operations to protect the integrity of a person’s final wishes.

Near the end of his life, Peter Brickfield was practically bedridden and unable to communicate. He was overfed and his life was being medically prolonged against his written wishes, said McRae, who visited the Islesboro home. She was moved to tears when she left their house, McRae said.

Boucher told the Monitor he acted in the best interests of the Brickfields and did nothing wrong. He asserted that he had been vilified and had to spend thousands of dollars to defend himself in probate court against McRae’s allegations. He has not been accused of criminal wrongdoing and no civil complaint has been made against him.

The Brickfields had a team of doctors and in-home nursing care, Boucher said. He added that McRae did not understand that the Brickfields wanted the same lifestyle they had always enjoyed in their home through the end of their lives.

“They lived exactly the way they died, except for the last few months where there was a conservator who didn’t know them and didn’t understand their wishes,” Boucher said. “They made their choices and I vowed to follow their wishes.”

The probate judge temporarily appointed McRae as Peter Brickfield’s conservator. McRae moved Peter Brickfield to hospice, and he died at age 77 on Nov. 16, 2020.

“For me, keeping someone alive against their will and treating them that way is horrible. If you want to talk … (about) being cruel to someone, he was right up there,” McRae said of Boucher. “That’s so much worse than just money.”

Million-dollar questions

McRae has worked on probate matters from the inside and outside. She served for four years as the Cumberland County Probate Court register, which is the top probate court clerk position. Now, as a private guardian and conservator, her services come at a premium, costing $210 an hour.

Conservators are appointed to manage the property or financial affairs of a person under a protective order of a probate court. Guardians are also appointed by the probate court and have more sweeping powers to make decisions about an incapacitated adult’s living situation, health care and money.

McRae said her job as a conservator is to protect the assets. If the adult under conservatorship had given their grown children money in the past, and could afford to keep doing so, she would approve it. But when family members try to remodel homes under the guise of caring for the person, she objects. Each time she has to weigh the cost of clawing back money she believes has been misspent.

“I’m not going to spend $20,000 to find $100. It’s not happening,” McRae said.

But the Brickfields’ trust was different, McRae said.

Approximately $1 million a year was spent from the trust to care for the Brickfields, which seemed “exceedingly high for one or two people who are homebound,” McRae reported to the probate court. A portion of the spending could be ascribed to their wealth, which included two homes. But a large portion of the rest of their expenses tied back to personnel in the house, according to her analysis.

“I don’t know how you would spend a million dollars. You’d have to pay people $45 or $50 an hour, and that’s not what care costs,” McRae told the Monitor.

Boucher tells a very different story. McRae’s inspection was “bogus,” Boucher said in an interview. He worked with the Brickfields as a caretaker of their island home for 35 years, and they nominated him to make health care decisions, serve as conservator for Peter Brickfield and trustee of their assets. Before they fell ill, the Brickfields made clear they wanted to stay in their home, surrounded by 24/7 nursing care, a chef and gardens, Boucher said.

“It was a multimillion-dollar scandal, and hijacked by the state court system,” Boucher said. “Basically, I can tell you that both the Brickfields, especially the last survivor, died a very miserable, unhappy death because of the court system and a court-appointed conservator who hijacked the Brickfields’ finances.”

McRae raised questions with the probate court about other purchases made from the trust, including a $14,000 lawn mower, $6,300 paid to Boucher’s wife, and thousands of dollars of undocumented purchases at auto- and home-repair stores.

Boucher, through his lawyer, told the probate court that his wife was paid to go through boxes of personal items to assist accountants with the Brickfields’ taxes. He added that he did not recall the exact reason for many of the other expenses, but that decks, handrails and stairs were built and other items improved the property.

Boucher was late with some required annual conservator accounting reports and had to be reminded by the probate court to file, probate records show. Boucher said this was true, but blamed the tardiness of the reports on an accounting firm that was hired around the time Mary Ann set up the trust. A friend of the Brickfields who lived in Washington, D.C., was also named as a co-trustee, but could not be reached for comment.

A private company that later took control of the Brickfields’ trust notified the beneficiaries of McRae’s report and did not file a complaint against the trustees. Trust money that has been allegedly mismanaged does not need to be recouped if a lawsuit would be “uneconomic,” then-Waldo County Probate Judge Sean Ociepka decided. Ociepka declined an interview request by the Monitor.

Records reviewed by the Monitor show the state attorney general’s office spoke with at least two lawyers involved with the case, and did not file criminal charges. Both lawyers declined the Monitor’s request to comment about the case. The attorney general’s office also declined to comment further.

As they wished, about $4.6 million from the Brickfields’ trust was distributed after their death to Georgetown University, the University of Pennsylvania, George Washington University Law School, and nonprofits in Maine and D.C., probate records show.

Finding fraud

Guardianship and conservatorship are good public policy, but it is the state’s responsibility to ensure there is integrity in those systems, said Anthony Palmieri, chief guardianship investigator for Florida’s Office of Public and Professional Guardians, which investigates and disciplines guardians of indigent seniors.

Palmieri, a career fraud investigator, also works as the deputy inspector general at the Clerk of the Circuit Court and Comptroller office for Palm Beach County.

Palm Beach County set up one of the nation’s first guardianship fraud hotlines, which receives 150 to 250 calls a year from neighbors, attorneys and judges who suspect an incapacitated person is being preyed upon by a guardian, Palmieri said.

The Division of the Inspector General also audits and does risk assessments of conservators’ reports to match account balances to bank statements. The division is accredited like law enforcement and employs investigators to do unannounced, surprise visits with guardians, conservators and their wards, he said.

“It sounds simplistic, but if you don’t have a program designed to look for fraud, you’re not going to find fraud,” Palmieri said.

Maine’s probate courts don’t have any of that.

Moore, the register of the Lincoln County Probate Court, said there is not enough time or personnel in the register’s office to audit conservators’ accountings, or follow up on the details in many estates. Once the paperwork is filed with her office, it is sent to the probate judge to review and the probate court’s work is done unless the judge asks for more information, Moore said.

“I don’t have enough time. With everything else that we do in our office, I wouldn’t have the time to sit down and to audit or to go through all the reporting that we get on the filings,” Moore said.

Financial exploitation is the third most common allegation investigated by Adult Protective Services in Maine, according to a report released this year.

The agency substantiated 15% of the 1,696 financial exploitation allegations reported in the past two years involving people over age 60 who were not receiving developmental services. Financial exploitation cases took the longest to investigate because they often involved working with financial institutions, credit card companies and professionals to obtain documents, according to the report.

Adult Protective Services can ask a probate court to appoint a public guardian or conservator to protect a person who cannot make decisions for themselves. But the agency is required to exhaust all other options before seeking a public guardian, according to the report.

Maine needs to do more, said Moore. She and Kennebec County Probate Judge Elizabeth Mitchell were asked by state lawmakers in October to explain the probate courts’ guardianship process after the Monitor reported that eight adults assigned public guardians had died in unexplained ways.

The legislative hearing primarily focused on the state’s ability to monitor the care people receive under guardianships, which is another of the probate court’s responsibilities along with oversight of estates.

State lawmakers concluded there needs to be better communication between Adult Protective Services and the probate courts so there is more intensive oversight and frequent reviews of guardians to identify potential abuse, neglect or exploitation.

“I don’t have an answer, but I feel sometimes there’s not enough being done. We could do more,” Moore said.

Maine probate courts lack audit process

Family members told the Monitor they have few places to turn when they believe a loved one’s money is being misspent while the probate court is supposed to be a watchdog.

Shirley Cooney’s conservator, for example, spent $2,800 during Cooney’s last seven months for 56 “companionship visits” from a woman hired to bring Cooney’s dogs to visit her at an assisted living facility, then sit and chat for an hour.

There were also thousands of dollars of legal fees, hundreds of dollars reimbursed to Cooney’s guardian, and various charges for clothes and home heating oil.

Her daughter, Elizabeth Cooney, tried to get actual receipts for those visits and the other expenses. But her grievances were mostly dismissed by the Cumberland County probate judge.

“It’s a … nightmare,” Elizabeth Cooney said of the operation of Maine’s probate courts.

One potential model for more rigorous oversight of conservators can be found in Minnesota. The Minnesota Judicial Branch led the nation in 2012 by launching a statewide Conservator Account Auditing Program to protect the assets of people in conservatorships.

The state audits each conservator after their first year and every four years thereafter. A review team also checks conservator accountings yearly for red flags — such as excessive fees or cars purchased when the person under conservatorship didn’t have a license.

Jamie Majerus oversees both programs in Minnesota. They review an average of 5,400 accounts a year, which include $1.2 billion of bondable assets and does not include real estate, she said. Majerus is a certified public accountant, certified internal auditor and certified fraud examiner with a degree in accounting.

“People know they’re going to be audited. It’s not a question of “if I will be audited,” like the IRS,” Majerus said. Conservators “will be audited because we have these programs,” she added.

The audit program has proved a strong deterrent to anyone who would consider taking advantage of a person under conservatorship, and Minnesota saw a steep decline in conservators committing fraud from the start of the program until about a year ago when her office started to detect an increase in attempted fraud, Majerus said.

Conservators self-report transaction-level details and upload supporting documents through an online platform. Minnesota no longer accepts paper filings because the level of detail is so poor they are a “waste of time,” Majerus said.

All of Minnesota’s reviews and audits are done by 18 state employees with degrees or work experience in finance. The work is too complicated to be done by local court clerks, Majerus said.

The reviewers and auditors send a report with their findings and recommendations to the judge, who can order a conservator to repay money, go after the conservator’s bond or criminally prosecute a conservator who has appeared to have acted improperly.

“We want to ensure that the money that’s being taken care of by the conservator is being protected and that it’s being well-managed. That’s ultimately the goal,” Majerus said.

Several Maine probate courts said they do not audit how conservators are spending money, according to a Monitor survey. But a few do.

Knox County for example, has a probate clerk review the accounting reports that are filed once a year by conservators. The clerk looks to see that the expenses and incomes balance, and reviews supporting documents the conservator submits to see if money is being spent on anyone other than the person under conservatorship. Yet, conservators aren’t required to provide supporting documents.

Roughly two decades ago in Maine, conservators had to bring canceled checks at the end of the year to the probate court registers to review and approve, said Knox County Register Elaine Hallett, who has been with the probate court for more than 45 years.

“It’s just how it was done back then,” Hallett said.

Maine’s probate courts still rely on paper forms, which are scanned and made public online. Unlike Minnesota, the financial data that is collected cannot easily be analyzed.

Maine’s conservator accounting form requires less information than in the past, Hallett said, although she did not believe it was a bad change. She said she didn’t think Knox County needed more oversight of its few conservators, who are often parents of adults with intellectual disabilities who receive Social Security.

Majerus said Maine’s process to review conservator accountings has gaps: “My opinion is yes, things will get missed.”

Multiple lawyers disciplined for probate misconduct

Lawyers disciplined for professional misconduct during probate matters make up a small portion of overall attorney misconduct in Maine, but probate work is a factor in an oversized portion of cases that lead to actual disbarments.

Of the nine lawyers disbarred in Maine since 2015, five committed misconduct that involved probate cases in Maine or other states.

Ellsworth attorney Christopher Whalley was disbarred in December 2022 amid allegations he used client money to write dozens of checks to his law firm while he was the personal representative of the client’s estate, the Monitor reported. It took three years and multiple complaints for the state to detect what Whalley had done.

On Dec. 6, 2022, Whalley wrote a check for $207,109.42 to the estate, which “fully reimbursed the estate for the misappropriated funds,” Washington County probate records show.

A grand jury indicted Whalley on felony theft charges in February. A grand jury indictment is not a finding of guilt. Whalley pleaded not guilty to the charges, and no trial date has been set. Whalley did not return a phone call seeking comment by the Monitor.

Another lawyer, Jonathan Hull of Newcastle, was disbarred in 2020 and pleaded guilty to taking money from two nonprofit organizations in August of that year, The Lincoln County News reported.

A decade earlier, Hull withdrew approximately $47,300 from an estate for which he was serving as personal representative in the Lincoln County Probate Court, discipline records show. The attorney general’s office investigated Hull related to the estate money but did not prosecute him because the six-year statute of limitation had passed, according to discipline records.

Hull declined to comment when reached by the Monitor in November.

The Lincoln County Probate Court didn’t make changes to prevent misspending of estate funds. Moore, who is now the court’s register and was working at the probate court while the case was happening, said she didn’t know what the probate court could have done differently.

Complaints are taken seriously, Moore said. But even the complaint process lacks a clearly defined procedure. With no set protocol, Moore said she would likely write a note, pull the case file and talk to the probate judge.

“The only trigger would be if a family member came forward and said, ‘Gee, something isn’t right,’ or they have questions or concerns,” Moore said. “I’m not aware of any safeguards.”

The state Board of Overseers of the Bar is supposed to keep a watchful eye on lawyers found to have committed acts of professional misconduct, but that isn’t always an effective deterrent.

In another case, Jeffery J. Clark testified that his Christian faith compelled him to become the caregiver of Eugenie “Genie” Landry. Clark then wrote a will for her that made Clark the primary beneficiary, discipline records show.

“I made a huge error, which I admitted and for which I was suspended,” Clark wrote in response to questions from the Monitor. He said Landry was a friend. “She was much more than a client. I regret what occurred and I am mad at myself for disappointing Genie.”

In 2004, while Landry was in a hospital, Clark asked an attorney with his law firm to witness a will that left the vast majority of Landry’s oceanfront property to Clark. Clark received about $325,000 after Landry’s death, which he used to pay off his mortgage, board records show. He later returned the money to the estate, probate court records show.

“His claims of humanitarian service, based upon Christian ideals, are rendered hollow by his participation in his client’s estate,” state Supreme Court Associate Justice Andrew Mead wrote in a 2008 decision to suspend Clark.

Mead ordered Clark to stop practicing law for a month and report all his clients age 60 and older to the Board of Overseers of the Bar.

But Clark surfaced in another case that same year.

That case involved John Goodwin, a Cape Neddick man in his late 60’s. Documents reviewed by the Monitor show Clark was retained in 2004 and revoked a daughter’s power of attorney to make medical decisions on Goodwin’s behalf, after Goodwin had a devastating stroke where he lost most of his ability to speak.

By 2008, though, Clark told the Monitor, Goodwin was no longer a client of his. Clark did not report Goodwin as a client to the Board of Overseers of the Bar when Clark’s court-ordered monitoring began in February 2008.

Just 13 days before Clark’s license to practice law was to be suspended on April 1, 2008, Goodwin signed a new will prepared by one of Clark’s law partners and notarized by Clark. It dramatically changed how Goodwin’s properties would be divided between his daughters, grandchildren and acquaintances.

“When you look at it, you say ‘How did this happen? How could this possibly happen?’ ” said his daughter, Jennifer Goodwin. “… My dad had a really comprehensive estate plan, so for any of this stuff to happen was just, like, mind-numbing.”

Clark said he served only as the notary, and explained that his role was to determine John Goodwin’s capacity to sign the new will. Jennifer Goodwin said her father could not write or speak and was unable to communicate or express himself at that time.

“John had trouble speaking because of his stroke, but I determined that he could communicate adequately his desire to execute his will,” Clark wrote in response to questions from the Monitor.

Clark said he did nothing wrong and he never communicated with John Goodwin about his estate or family. Clark is now retired. He said Jennifer Goodwin was consumed with bitterness.

Jennifer Goodwin later filed a lawsuit in state court alleging Clark and others interfered with her inheritance. Clark and other respondents denied wrongdoing. The case was later dismissed because Jennifer Goodwin did not add her sister and others quickly enough to the case. An appeal of the dismissal is pending with the state Supreme Court.

Torn apart

Even in death, Mainers have few protections in probate court.

Rebecca Theriault’s estate, for example, was presented to the Kennebec County Probate Court on a four-page form submitted by her husband, Tim Theriault, the former China Village fire chief and state Republican legislator. He checked off a box that indicated Rebecca left no will, and he signed the form under the penalty of perjury.

But there was a will from 1987 that left everything to Rebecca Theriault’s three children.

Tim Theriault said that he did not know that Rebecca, who was a widow, had written a will before they married.

The will set off a two-year legal battle after she died in August 2021, fracturing the family and ending in a settlement that divided the properties and remaining money.

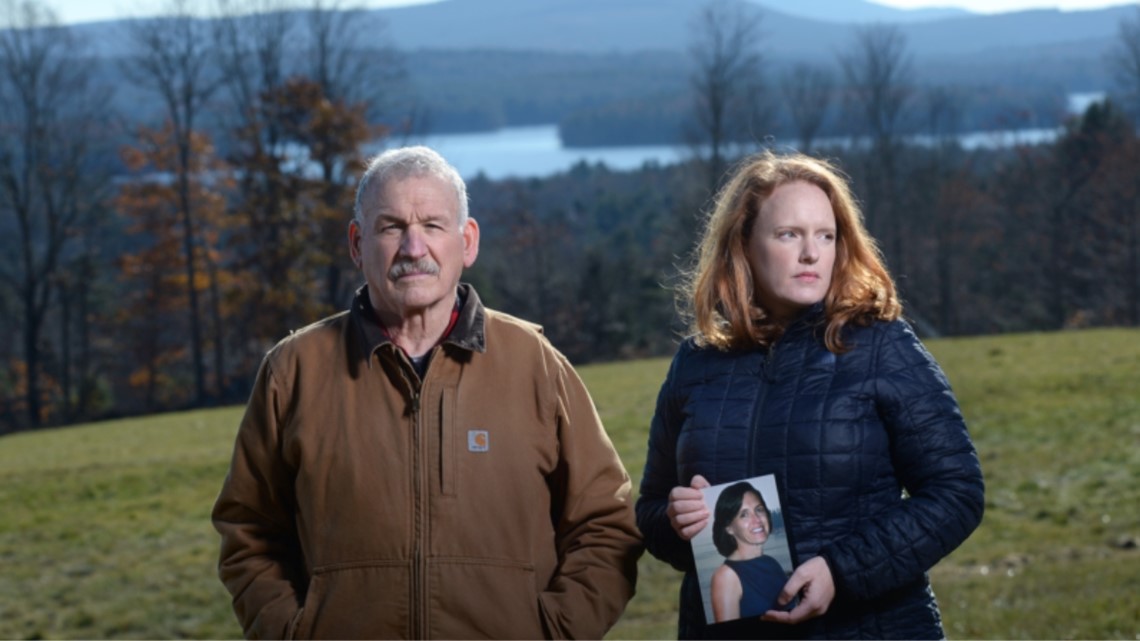

“This is tearing the whole family apart,” said David Marceau, who is Rebecca Theriault’s brother and the person she nominated in 1987 to oversee her estate after her death.

The family was still in shock and grieving Rebecca Theriault’s death from cancer when a letter arrived saying her husband had been appointed to oversee the estate, Marceau said. Rebecca’s youngest daughter, Crystal Chappell, said she was surprised by the probate court’s lack of diligence in checking to see whether there was a will.

Tim Theriault spent money from Rebecca’s estate to continue building a home while serving as the personal representative, according to a deposition he gave in April 2022. It was a new two-story lakefront house with a deck overlooking China Lake in Kennebec County. Tim Theriault later said the house was not a part of the estate.

Marceau’s lawyer submitted the missing will and asked the probate court to remove Tim Theriault as personal representative of the estate. Chappell also subpoenaed her mother’s bank records.

“The bank statements confirmed what we thought, which was that while he was acting as personal representative and there was a petition in place for removal, that he had spent hundreds of thousands of dollars in estate funds,” Chappell said.

Rebecca and Tim Theriault owned multiple properties in Maine, but his name was not on all the deeds or bank accounts.

Surviving spouses have a right to a portion of the deceased’s property under Maine law, and Tim Theriault testified during a deposition that, “That law protected me from her will. I thank God for that.” Otherwise, he said, his wife’s will would have left him “homeless.”

Tim Theriault told the Monitor that he could not find all of Rebecca’s money, which became a major controversy in the probate court case. He knew bank accounts existed but not where they were located, he said. He used the bank account he was able to locate with the belief he was entitled to half as her spouse under state law, he said.

Tim Theriault said his three stepchildren are “ungrateful and disrespectful.”

“I tell everyone I’m seeing right now, ‘If you don’t have a will, go get a will, because it’s just horrendous these kinds of things can happen.’ It’s sad,” Tim Theriault told the Monitor.

But it took five months to schedule a court date, at which Tim Theriault voluntarily resigned as personal representative of his wife’s estate. The probate judge ordered an independent fiduciary to take over and later to produce an accounting of the estate. Mediation after mediation failed as the family tried to determine what belonged to the estate.

Tim Theriault told the Monitor that his experience with the probate court was “miserable.” The probate judge did not want to make decisions about anything, Tim Theriault said.

Chappell agreed and said the probate court wasted time by not making decisions to its own detriment.

“Not only would it have saved the siblings money in legal fees, but think about all the time that the judge had to spend. We went back to court at least half a dozen times in a court system that is already overburdened and doesn’t have time for these cases,” Chappell said.

In the end, five lawyers for various family members hashed out the details of what Rebecca Theriault’s final wishes would be. The lawyers huddled in the probate court’s hallways and scribbled out the settlement by hand on lined paper, which their clients then agreed to and signed.

The judge agreed.

This story was originally published by The Maine Monitor, a nonprofit and nonpartisan news organization. To get regular coverage from the Monitor, sign up for a free Monitor newsletter here.

Don’t miss these NEWS CENTER Maine stories