BIDDEFORD, Maine — With concerns over the spread of the new coronavirus, Gov. Janet Mills mandated the closure of non-essential businesses Tuesday. Gov. Mills initially urged public-facing companies to close down last week. Now many small business owners are left with no income from in-person customer contact.

There are financial resources popping up as closures trend upwards nationwide. The Small Business Administration made disaster loans available and the Financial Authority of Maine has a COVID-19 Relief Consumer Loan Program.

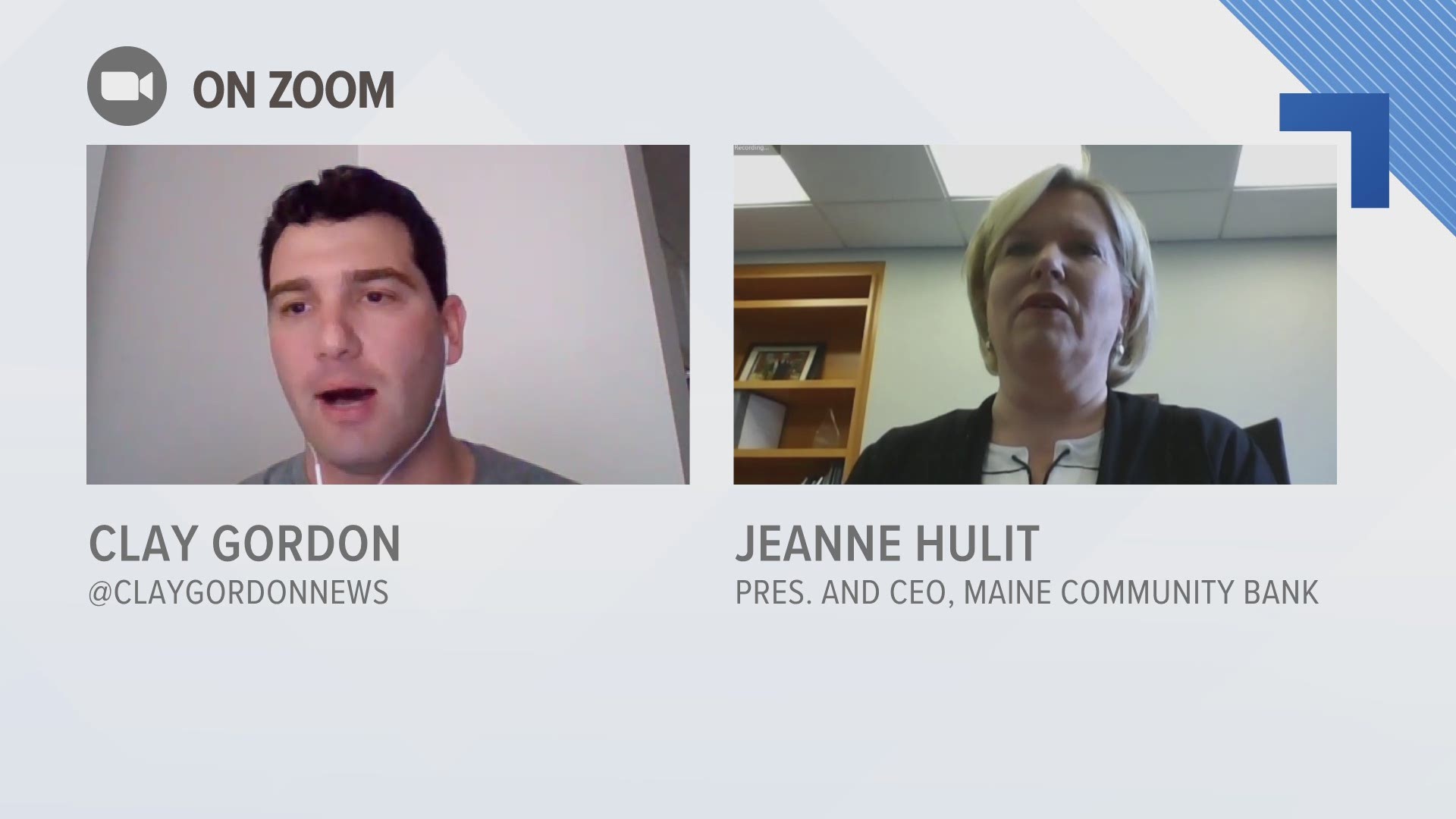

Jeanne Hulit is the President and CEO of Maine Community Bank Corp. Under President Barack Obama, Hulit serviced as the Acting Director for the U.S. Small Business Administration. She recommends checking with an expert to see if a loan through the SBA or FAME is right for your situation.

"What we're trying to do is encourage businesses to work with their lenders, that they have a relationship with, so they can get counseling about what is the best solution for them," said Hulit. "We don't want them taking on additional debt until they know when the business is going to open back up."

Hulit says small business owners have been informing them of their current status and are looking for guidance.

"Many of them need some immediate assistance and we're offering some payment deferrals or interest-only loan payments for up to three months while they figure out what's going to happen to their businesses."

Hulit says you can talk to your financial institution about immediate relief on loan payments and they might be able to defer payments. The SBA's Economic Injury Loans can provide longer-term support to help companies rebuild, but it requires more paperwork, according to Hulit.

Maine Department of Economic and Community Development business resource guide