PORTLAND, Maine — From housing to used cars, groceries to household bills, the cost of living continues to increase. As costs change, it's important to revise your household budget.

Brenda Pollock is a financial counselor for Evergreen Credit Union. She shares a few different ways to keep yourself financially on track:

Revisit your household budget or start from scratch and create a brand new budget. There are several budgeting styles that people can use to stay on top of their personal finances.

Before you sit down with the family to determine what type of budget is right for you, it is so important that everyone in the household understands the worth of money.

The reason for any budget is to identify the areas where you spend: recognize essential spending and non-essential spending.

Also, keep in mind, any successful household budget is the result of compromise.

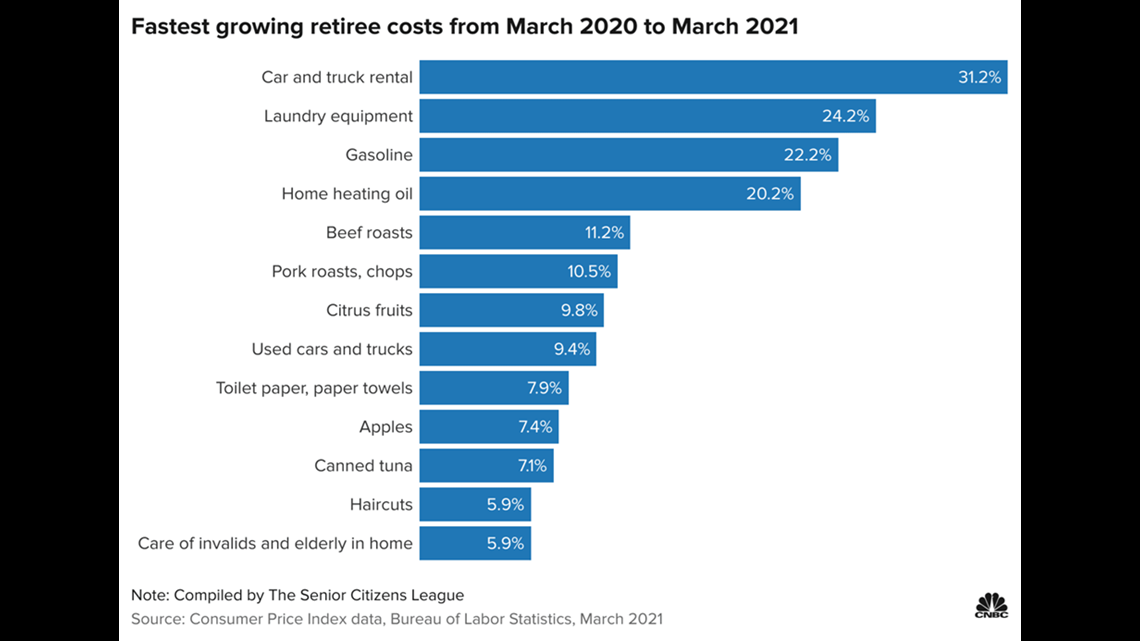

The recent rising costs are hard on everyone, but especially for retirees.

Here’s why:

Social Security cost of living adjustment was 1.3%, yet many of the costs seniors face are rising much more quickly.

From March 2020 to March 2021 the fastest rising cost was car and truck rentals which were up 31.2%.

Gasoline – Prices at the pump have climbed dramatically Up 22%.

Heating Oil up 20%.

Beef was up 11.2% to the cost of apples rising 7.4%.

There’s never been a better time to start from scratch with your household budget and stay on top of your finances. You should find a budget that works best for you and commit to it.

Traditional budgeting

First, make a list that breaks down all of your income and expenses. Create a simple monthly budget worksheet that allows you to see how your income and expenses stack up each month.

Pro: Traditional budgeting is a great way to put your income and expenses under a magnifying glass and help you reign in the spending.

50-20-30 budgeting

Also referred to as Proportional Budgeting, That’s when you commit 50% of your income to necessities – rent, food, utilities. 20% pays your financial obligations –here’s where you can prioritize getting out of debt and putting some away for retirement. And the final 30% is for non-essentials like shopping, traveling, or dining out.

Pro: This method is easy to use and gives you the opportunity to save some money for fun stuff.

Reverse budgeting

This is a technique that prioritizes debt repayment and your savings goals above everything else. With this method you focus in on one big goal each month. You accomplish your goal of the month first then use the remainder of the money to cover all your other expenses. This is the simplest budget method since you don’t spend much time tracking your spending. Although it is rewarding to accomplish a goal each month, it doesn’t provide much visibility into your spending.

Pro: You focus on paying off debt, but it only works if you’re disciplined and don’t create new debt.

Value-Based budgeting

This budgeting style helps you save for the things that you value most in life. Make a list of what matters the most to you. Then each month, pay your monthly bills and living expenses first. Then put your disposable income towards things that matter to you. For example, let’s say you have $800 left over at the end of the month, you may put $500 towards your future home and $300 towards a vacation.

Pro: This works well if you want to focus on what matters to you, however, it’s easy to overlook far-off goals like retirement savings.

If you're a first-time homebuyer, pick a budget that works for you and stick with it.

2.38-million Americans became first-time home buyers in 2020. As exciting as the transition is for these new homeowners, the financial side of owning their own place isn’t always as much of a thrill. In fact, living expenses could increase by 75% for a lot of these new homeowners. That means new homeowners need to seriously adjust parts of spending to sustain the extra costs and make the move less overwhelming. Budgets are a sure way to manage financial stress associated with homeownership and allows them to confidently hang that welcome sign at their new home.