PORTLAND, Maine — Ask any employee in your company and you’ll likely find that money is the number one source of stress. Studies continue to point to financial challenges as a source of concern for employees, which makes it a top priority for employers.

Productivity and quality of work diminishes as employees dwell on tough financial questions.

Several local employers are taking an initiative to reduce these distractions by including financial wellness tools and programs with other traditional benefits.

Financial woes are becoming quite commonplace in the workforce and it hurts businesses as much as it does employees. As financial challenges continue to stack up, employers will see:

• A decrease in productivity

• Poor retention rates

• Lost revenue

As their financial troubles grow, employees are crippled with depression and anxiety, which results in a loss of motivation and poor health (which then leads to increased healthcare costs).

Some of the top financial challenges for employees include:

• Increased credit card debt

• Student loan debt

• Unforeseen expenses

• Increase in the cost of living

• Sandwich generation – managing cost of children and caring for aging adults

• Lack of knowledge with financial planning

Employers can offer financial wellness programs without breaking the bank.

Employees should contact their financial institution to inquire if they have a wellness program. Two years ago, Evergreen Credit Union began to offer free financial lunch and learn programs for local employers.

These programs provide employees with support and guidance as they navigate common financial challenges. They can also provide the tools designed to keep them on the right track. This is a win-win situation.

It shouldn't be difficult or expensive to deploy and manage a financial wellness program.

The programs should be simple, effective and provide information to their employees. Counselors should work with the HR managers to address some of the financial challenges their employees are facing.

These programs should help employees identify their source of stress, then guide them towards finding solutions. Employees can work with financial coaches one-on-one to learn how plan a successful financial future.

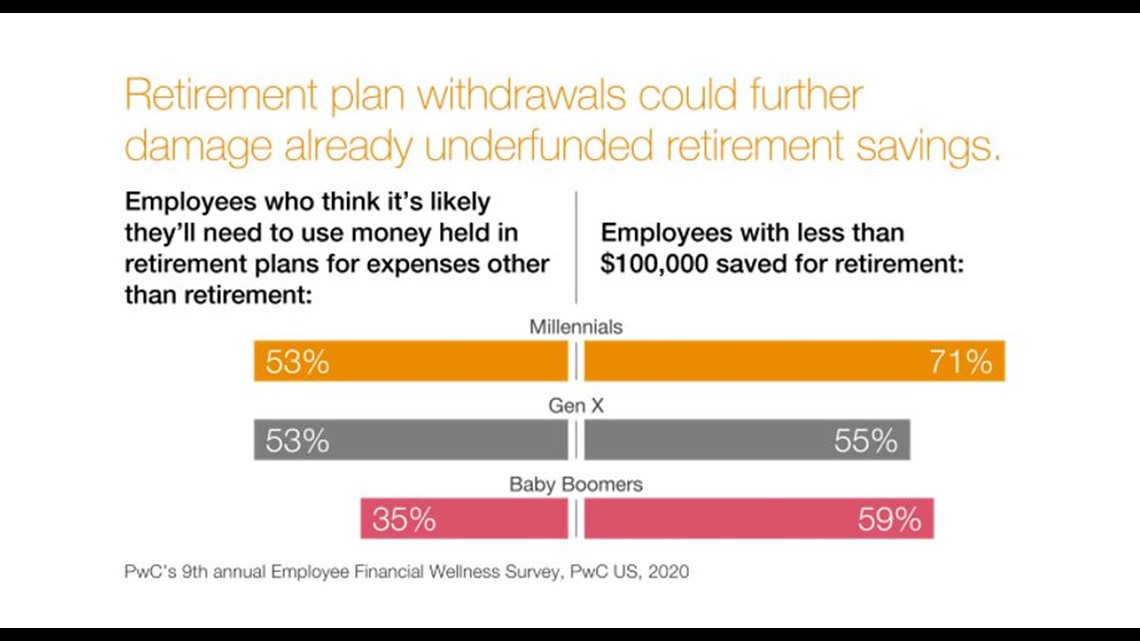

So many people have enormous debt and student loans are the common issue for millennials.

Student loan debt is becoming a common issue as more millennials enter the workforce. These loans often take years to pay off and are a distraction to employees trying to save for the future.

Good financial wellness programs should address paying off student debt, or refinancing student debt. Reducing this burden gives young employees the opportunity to plan for their financial future, while making them more productive and attentive in the workplace.

Tackling financial challenges head on in the workplace is beneficial.

The financial anxiety facing employees today is affecting productivity, which is why employers are expanding benefit programs to include financial wellness support. Tackle financial challenges head on and bring in the experts.

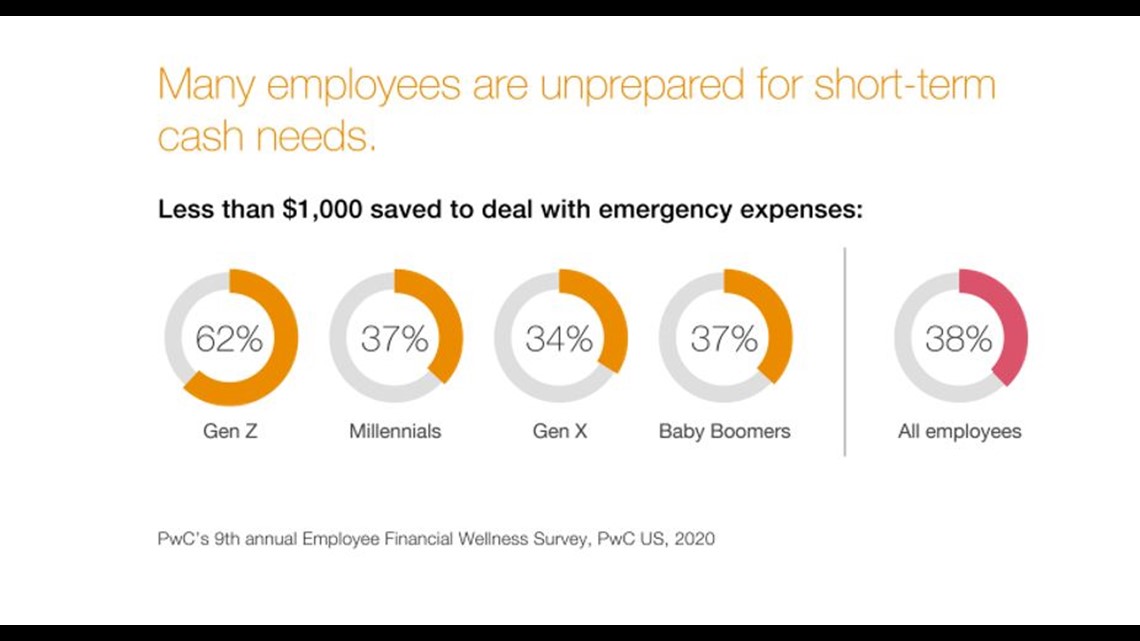

Employees are not prepared for an extended economic downturn. Financial Wellness Programs added to any employee benefits package is a wise venture.