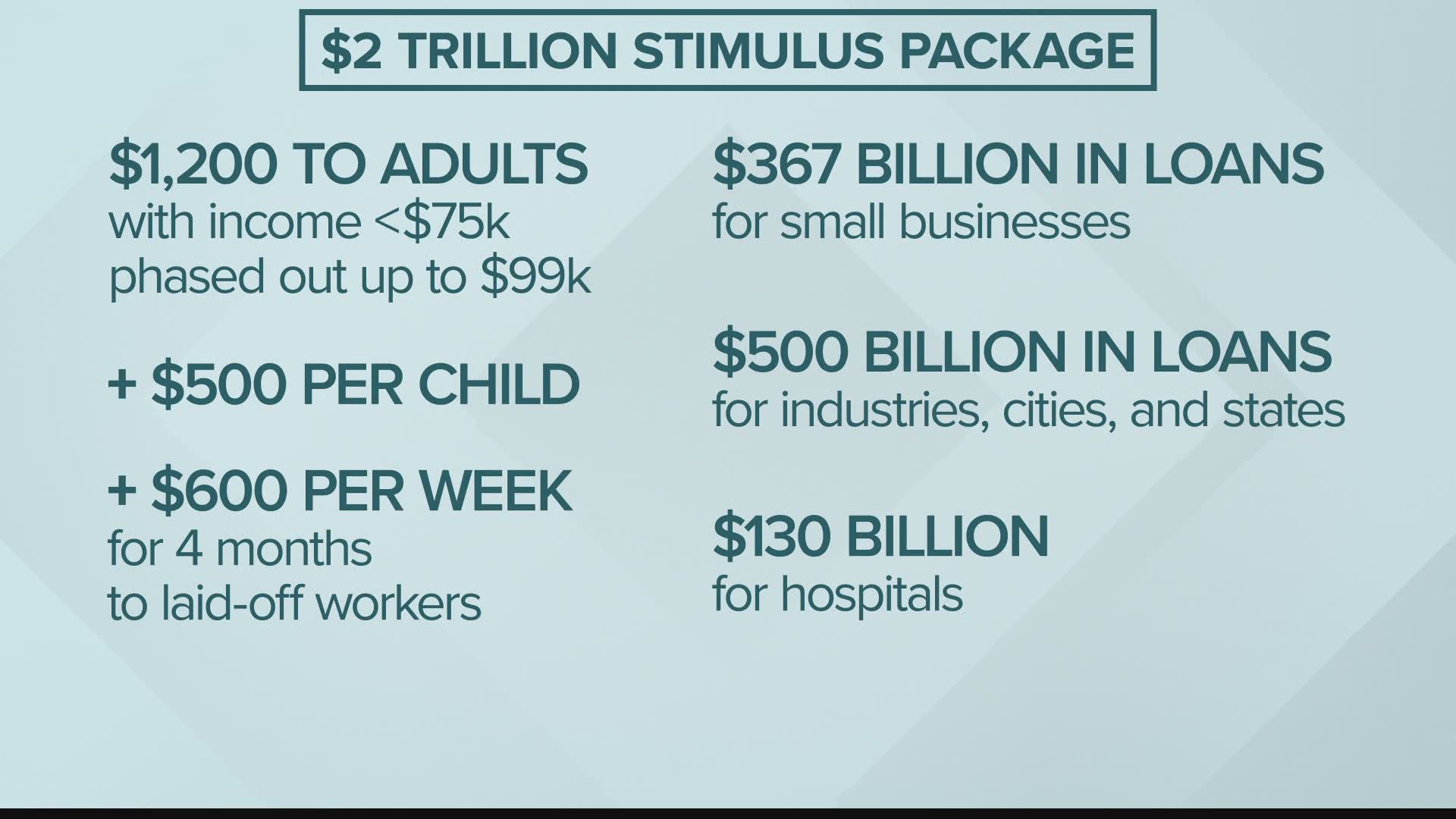

MAINE, USA — A lot of questions have arisen following Congress passing a $2 trillion bi-partisan stimulus package to provide relief during the coronavirus pandemic. One aspect of the package that's drawn a lot of attention is checks worth $1200 for citizens.

As part of this stimulus package, people making less than $75,000 per year will be eligible to receive that $1200 payment. Couples who file their taxes jointly who make less than $150,000 combined will also be eligible. For eligible families, they will also receive an additional $500 per eligible child.

For individuals who make more than $75,000 per year, or couples who make more than $150,000 are still eligible. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible.

People who receive social security are also eligible to receive an economic impact payment at part of the stimulus package, as long as they meet the income guidelines. Those people also have to have received a Form SSA-1099 for the year 2019. That's the form that highlights how much money you received as part of your SSI benefits.

Disabled veterans are also qualified, and the federal government is working to ensure those people do not fall through the cracks.

The amount you're eligible to receive will be assessed based on your 2018 or 2019 tax filings. Money is expected to be delivered in the next three weeks and will be sent to the address, or bank account associated with your tax filing. If you have not filed your taxes for 2019, the information from your 2018 filing will be used.

For those that do not have to file taxes each year like low-income taxpayers, senior citizens, some veterans, and individuals with disabilities are asked to fill out a simple tax form so they will be able to receive their impact payment.

The IRS announced Wednesday that those who receive Social Security benefits and are not typically required to file tax returns will also not need to file one to get their stimulus check from the record $2.2 trillion coronavirus aid package. That's a reversal from a previously announced policy.

Instead of having to file a "simple tax return," payments will be automatically deposited into their bank accounts, according to Treasury Secretary Steven Mnuchin.

“We want to ensure that our senior citizens, individuals with disabilities, and low-income Americans receive Economic Impact Payments quickly and without undue burden,” Mnuchin said in a statement. “Social Security recipients who are not typically required to file a tax return need to take no action, and will receive their payment directly to their bank account.”

The IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate $1,200 payments to Social Security recipients who did not file tax returns in 2018 or 2019. They will receive these payments as a direct deposit or by paper check.

More questions can also be answered by visiting IRS.gov/coronavirus.

--

At NEWS CENTER Maine, we’re focusing our news coverage on the facts and not the fear around the illness. To see our full coverage, visit our coronavirus section, here: www.newscentermaine.com/coronavirus.