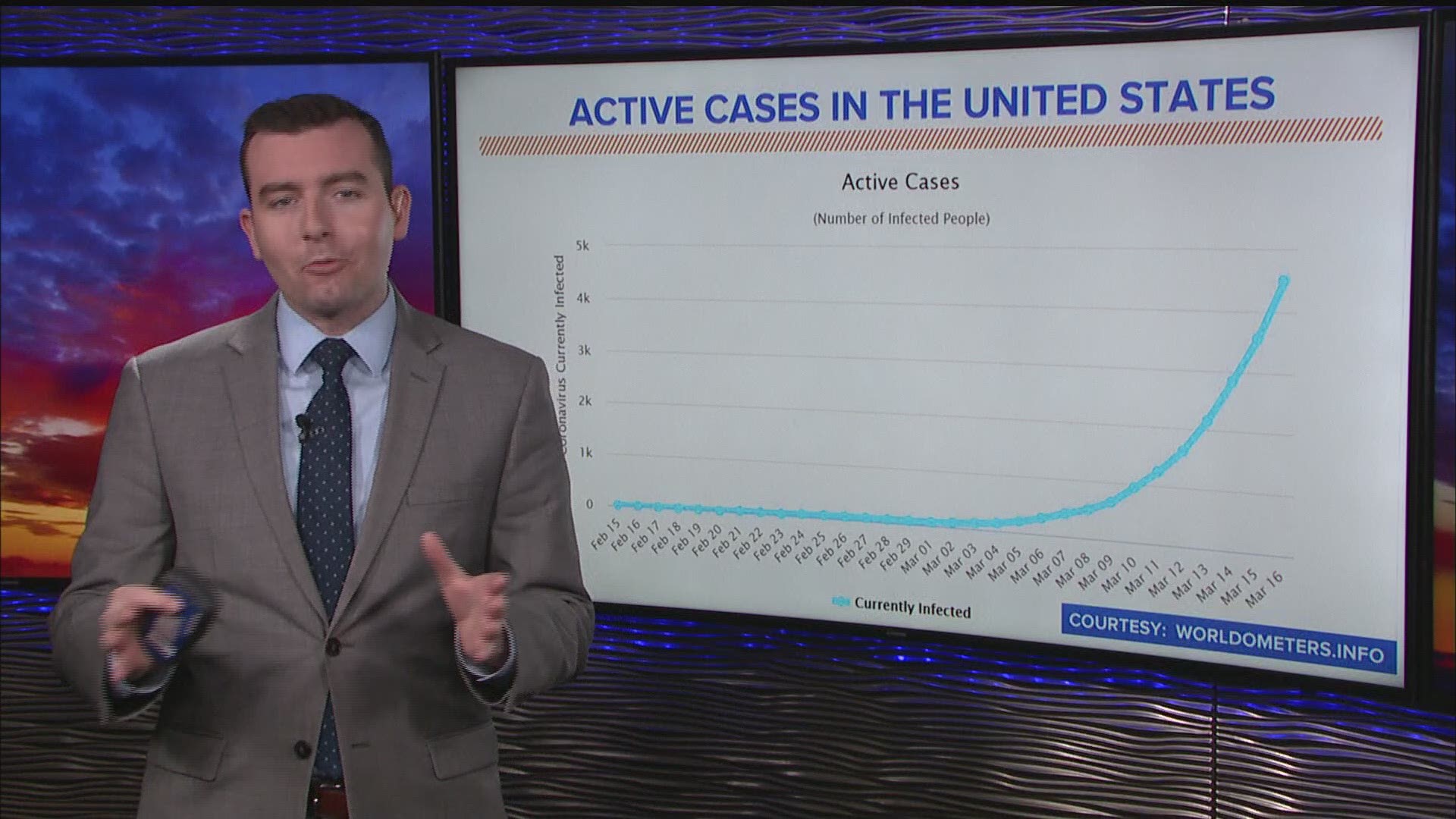

AUGUSTA, Maine — Editor’s note: You've probably heard the term ‘flattening the curve’ as a way to stem the tide of coronavirus cases. The above video explains what that means.

Governor Mills and Department of Administrative and Financial Services Commissioner Kirsten Figueroa Tuesday extended the deadline for second-quarter estimated tax payments to July 15 to provide Maine taxpayers financial relief during the coronavirus, COVID-19 pandemic.

“This pandemic has caused significant financial hardship for so many and I hope that, by extending the deadline for certain tax payments as we also did earlier this year for the state income tax, we can provide some needed relief and keep more money in the pockets of Maine people,” said Governor Mills.

This new change is in addition to the State extending the payment deadline of state income tax payments from April 15, 2020 to July 15, 2020. That change included any final and estimated Maine income tax payments due by April 15, 2020. Any failure-to-pay penalties and interest will be abated for the period of April 16, 2020, through July 15, 2020.

“By extending this tax deadline to match our previous extension of state income tax payments, we hope to minimize confusion and provide additional financial support to Maine people during this turbulent time,” said Kirsten Figueroa, Commissioner of the Department of Administrative and Financial Services.

In consultation with Governor Mills and Commissioner Figueroa, MRS is allowing this payment extension as authorized under Title 36 of the Maine Revised Statutes.

The extended payment due date includes second-quarter estimated payments, originally due June 15, 2020, for the following Maine tax types: individual income tax, corporate income tax, franchise tax, and fiduciary income tax for estates and trusts. The extended payment due date also includes any estimated or final payments, originally due April 16, 2020, through June 15, 2020, for fiscal-year filers, for the taxes listed above. For qualifying taxpayers, any related penalties and interest will be abated for the period of April 16, 2020, through July 15, 2020.

As a reminder, Maine income tax filers (calendar-year and fiscal-year filers) who are granted a federal extension to file automatically receive an equivalent extension to file their Maine income tax return. This includes the following Maine tax returns: Form 1040ME (Individual Income Tax Return); Form 1120ME (Corporate Income Tax Return); Form 1120B-ME (Franchise Tax Return), and Form 1041ME (Income Tax Return for Estates and Trusts).

Businesses and individuals are reminded that MRS continues its normal operations. This announcement does not affect the payment and filing due dates of sales tax and state withholding tax, which are “trust fund” taxes.

At NEWS CENTER Maine, we're focusing our news coverage on the facts and not the fear around the illness. To see our full coverage, visit our coronavirus section, here: /coronavirus