MAINE, Maine — Many Americans are actively looking for ways to trim expenses from their monthly budget. Inflation rates are also widely increasing the cost of essentials like food, gas, and car insurance, leading many people to look for ways save and spend less.

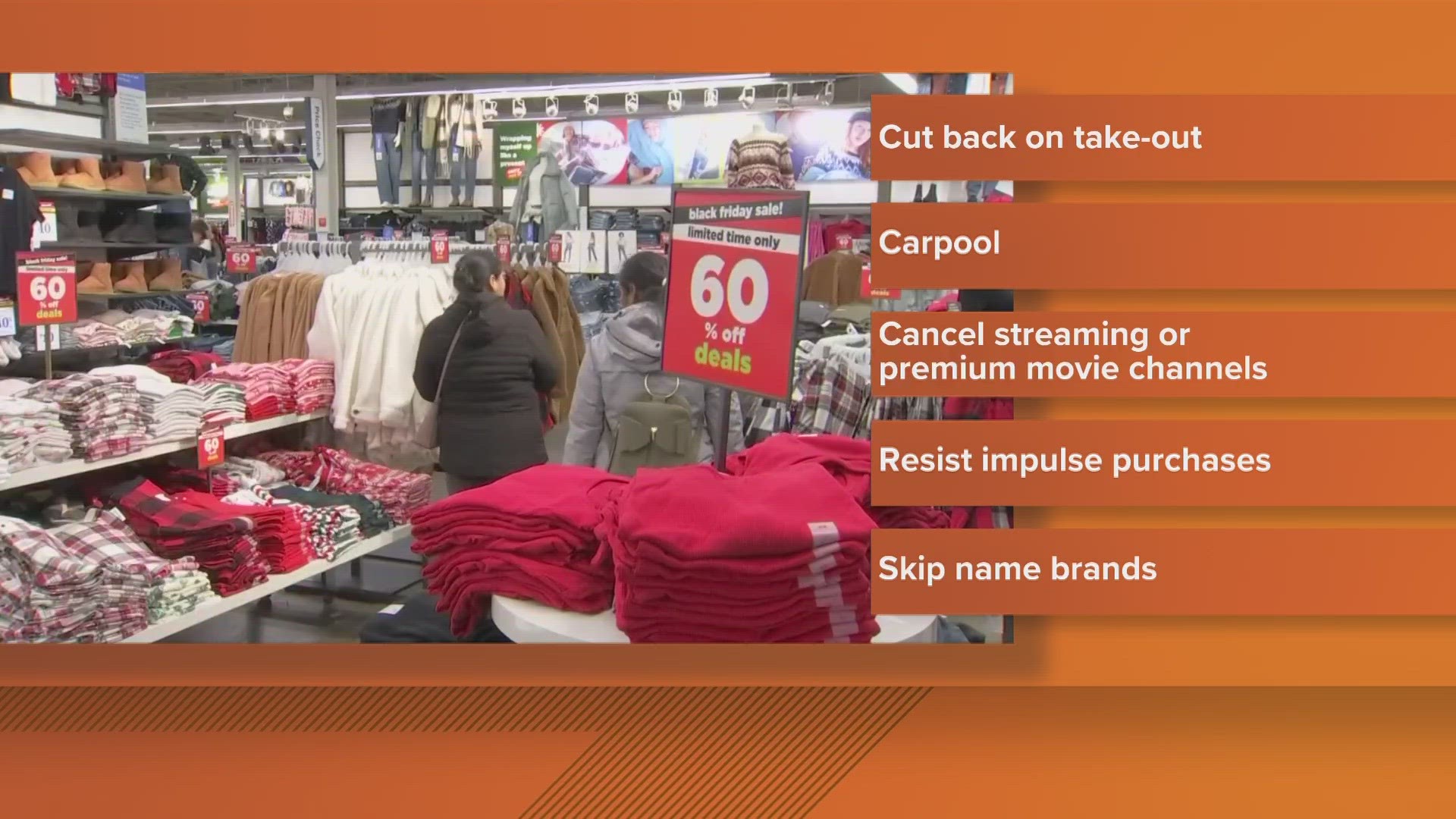

Here are some tips if you want to save more and spend less:

- Cut back on takeout orders.

- Set up a carpool to get to and from work.

- Cancel streaming services and premium movie channels that you don't often use.

- Try not to make impulse purchases.

- Skip the name brands.

- Use coupons and money saving apps when you buy your groceries

- At home, unplug appliances that you're not using to trim your energy bill.

- Switch to a cheaper phone plan that doesn't offer unlimited data.

Martha Johnston is the Finance Authority of Maine's director of education. She said it's very important for people to create a monthly spending plan.

"Most people call it a budget. You hear the b-word and they are like, 'Ugh, I don't want to live by a budget.' No, live by a spending plan, and when you make that spending plan, there's your opportunity to make sure that you are re-evaluating and you are looking for spending leaks," Johnston explained. "Are there some opportunities to cut costs? And when you write it all down and you stay organized, that's probably the best way to get started."

Johnston recommended setting attainable and reasonable goals.

"Do an inventory of all of your fixed monthly expenses, and make sure that you are getting the best possible deal ... Take a look at what you are paying for. Streaming, insurance, cellphone -- Are there some opportunities for you to find money?" she explained. "Anything that is negotiable, try to negotiate."

FAME offers free online financial wellness for all Mainers, which includes a budgeting tool to help you create a plan.

Johnston also added that once Mainers start getting tax returns, it's a good opportunity to set a plan, take inventory of expenses, and tackle paying off any debt.

Click here for more financial tips from FAME.