MAINE, USA — Advising workers, job seekers, and employers are now adjusting to the changes in state and federal wages and overtime that took effect simultaneously at the start of the new year.

The following changes went into effect on January 1, 2020:

- Maine’s minimum wage rises from $11 to $12 per hour for most workers.

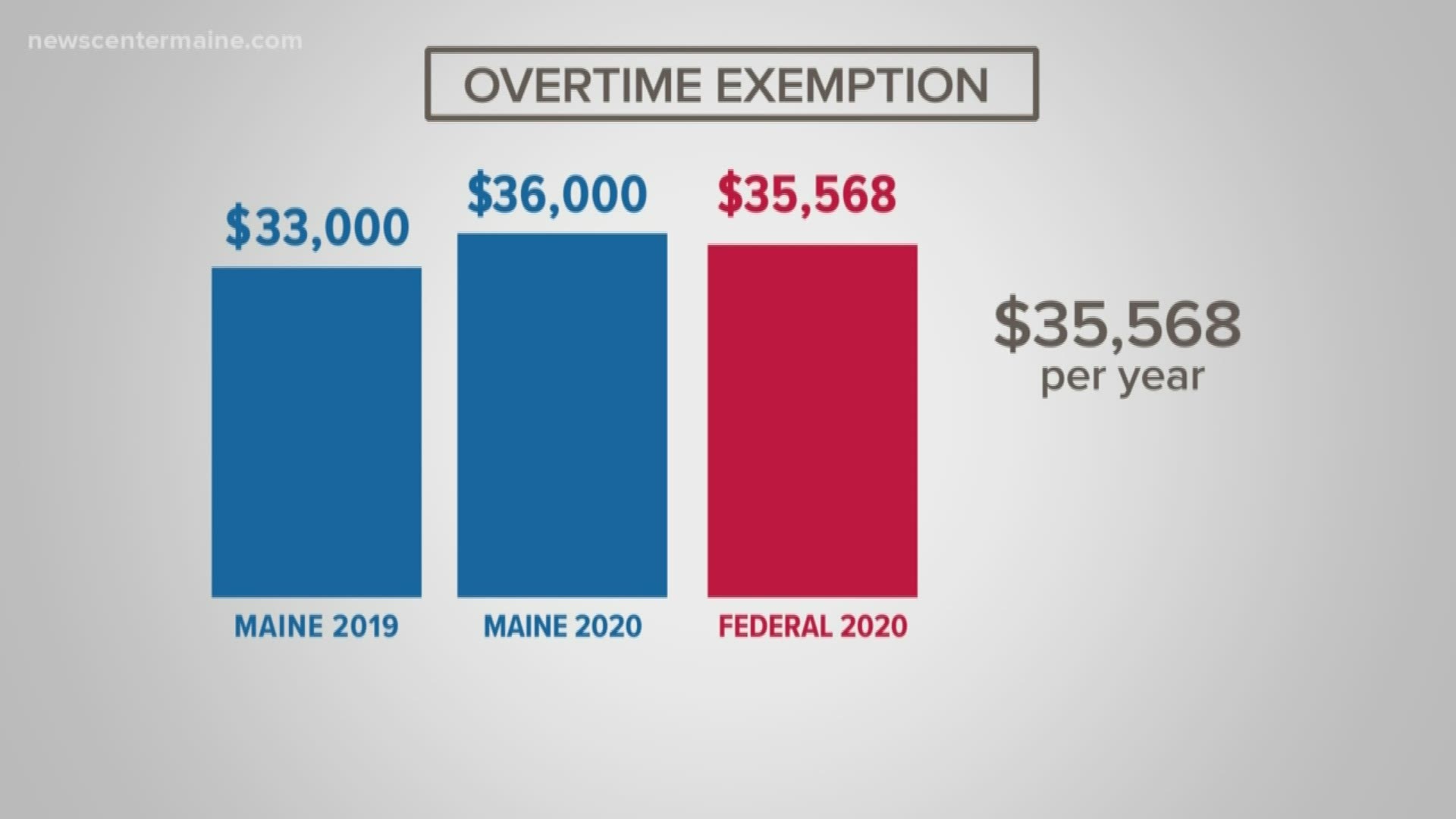

- The state’s minimum salary for exemption from overtime eligibility—which is tied by statute to Maine’s minimum wage-- rises from $33,000 to $36,000 per year. This translates to a minimum salary of $692.31 per week. If workers are paid at least this amount, and the work they perform meets the duties test, they are exempt from the overtime pay requirement.

- On this date, federal U.S. Department of Labor rules on overtime eligibility becomes effective. This means that the federal minimum salary for exemption from overtime eligibility rises from $23,660 to $35,568 per year for a full-time worker, which translates to a minimum salary of $684 per week.

Maine's salary threshold for exemption from overtime eligibility is now higher than the federal level.

Employers need to pay the higher state rate, as well as meet the "duties test" as defined in federal statute, in order to meet the overtime exemption threshold.

“The Maine Department of Labor estimates that approximately 1,600 Maine workers will be newly eligible for overtime pay protection due to the changes as of January 1st,” Maine Department of Labor Commissioner Laura Fortman said. “The Department’s responsibility is to enforce these laws and ensure that employers and workers are aware of coming changes so that they can be ready to meet the laws’ requirements.”

"We supported the twelve dollar minimum wage, but to be honest, it's getting more and more challenging because how much can you charge for a cup of coffee," Coffee by Design co-founder Maryallen Lindemann said.

Lindemann is now grappling with how to manage the wage increase that could subsequently come from raising the minimum wage. She also is concerned that to keep the business successful, she may have to change the benefits package or possibly raise prices.

"I want them to have a quality of life but I can't afford and stay in business, so where do I take it away from," Lindemann said. "We need to look across the board at housing, transportation and health care and have it be that it's not the employer who is having to bear the burden of all of it."

In addition to the salary threshold, there are several other requirements for exemption from overtime eligibility:

- The employee must be paid on a salary basis, regularly receiving a pre-determined amount of compensation each pay period;

- The employee’s salary must exceed a certain salary threshold (as of 1/1/2020, state increases to $36,000 as described above);

- The employee’s job duties must clearly fall within the executive, administrative, or professional job categories as defined in federal statute. There are slightly different tests for the administrative, professional and executive exemptions.

The Department of Labor's Bureau of Labor Standards is responsible for enforcing the state's minimum wage and overtime statutes, to ensure the laws are followed by both employees and employers.

The Bureau encourages any workers who feel their rights have been violated, or employers who have questions about the laws, to call or visit its website.